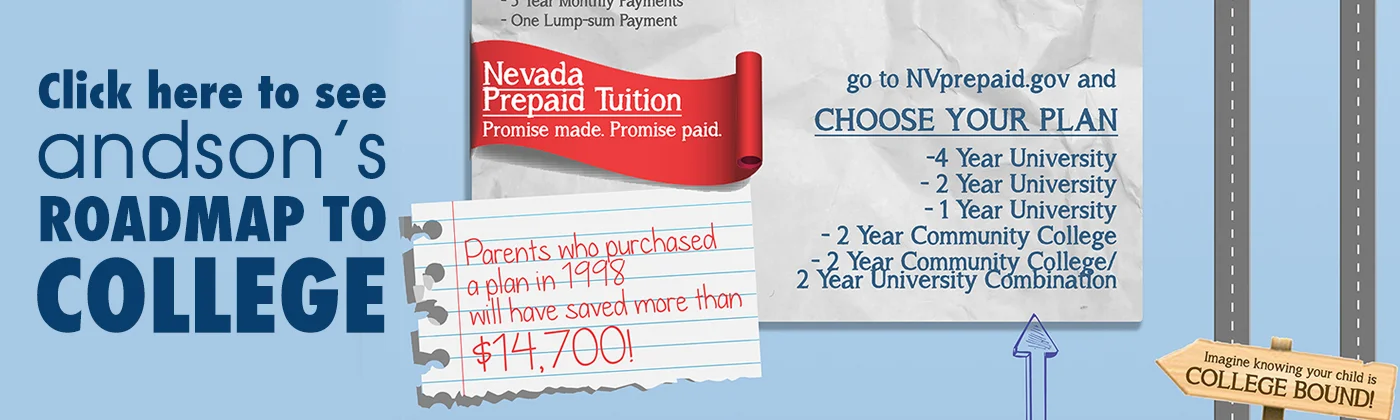

Andson's Roadmap to College!

We know that navigating through college savings plans can seem overwhelming.

Download it HERE.

Education + Personal Finance are the foundation of Andson's April workshops

Andson is constantly committed to teaching students Personal Finance skills. It's April! That means it's Financial Literacy MONTH! We have identified a few key areas that we can really have an impact for students in just one short lesson. Education is an investment that students NEED to make - whether trade school or college, students with a secondary education will have more opportunities than those who only graduate high school. So how can we make sure students have a foundation to understand that debt can hurt a student fresh-out-of-school faster than any other force?

In April, Andson's Financial Team will work with the following institutions to inform students about the pitfalls and positives of credit - as well as provide ongoing support to these student bodies.

- Desert Oasis High School - Seniors will go through an intense Debt and Financial Aid seminar on 4/23. We will be working with over 600 students!

- Nevada Partnership for Homeless Youth ⁃ Nevada has a serious issue with teens that are homeless. However, given the right resources, they can go on to be successful. These students, more than any other, need to be made aware of the resources they can use to fuel their mission of independence and success.

- Nevada State College is an amazing school in the southeast of Henderson. NSC and Andson are partners in so many activities, so it seemed only natural to bring a seminar on pitfall and installment credit to their student body. We are so happy to provide this as a resource to students in Southern Nevada.

We are so proud to be a part of Southern Nevada - let's give our students the resources they need to succeed!

Helpful Tips to Paying off Your Student Loan

When it comes to college, most people find the biggest struggle is being able to pay for it. Some people do not even go to college because of high tuition and other extra costs like books and parking passes. It seems almost impossible to attend college without having to take out a student loan. But once school is over and you get your degree, student loans are dropped on you and it is up to you whether or not you will successfully pay them off. People are defaulting more than ever because of the unexpected high monthly payments. People do not consider the interest of a loan, how long it will actually take to pay it off, or that maybe their career will not be as successful as planned. The best way to avoid the unexpected feeling and stress of student loans is planning. The sooner you start planning for college and researching different types of tuition plans, the more control you will have of your future. You never want to accept the first plan that a person hands you. Researching and talking to advisors will help you decide. Advisors can be anyone from a financial advisor to a friend that you trust.

Be prepared to start paying off your student loan as soon as possible. A big way to put a dent into your student loans is to pay more than the minimum payments. Even an extra $20 can make a difference. The extra $20 can come from budgeting your money properly.

These are just a few helpful tips for you but there are several different ways to help you with your student loans. Again, planning is key! Prepare yourself for a more successful future!

To obtain more information, read:

http://finance.yahoo.com/news/6-tips-paying-off-student-132815610.html

We are at Nevada Assets and Opportunity Summit!

We are at a conference in Reno, NV right now. Boring? Absolutely not! Today we are so lucky to have NV Treasurer Kate Marshall with us. (Shameless Plug- Ms. Marshall recently visited The Piggy Bank at Bracken). Our lunch keynote speaker was Jose Cisneros, city of San Francisco Treasurer - who talked about the extensive Financial Services they've come to provide. A great City, yes; but totally replicable (and the city of San Francisco is committed to helping do this in other cities!)

Inspiration in the workshops today is incredible. Anee Brar heads up the city of San Francisco's K-to-C program; every child that starts Kindergarten gets a savings account with matches and incentives for college. IF YOU HAVE A SAVINGS ACCOUNT FOR COLLEGE - YOU ARE 6 or 7 TIMES MORE LIKELY TO GO TO COLLEGE. Parent Engagement is also important so we hope to be able to share common and best practices in the future.

The afternoon session was Behavioral Economics, hosted by PHd students from UNR, as well as Mark Pingle, professor of Economics from UNR. It was very interesting to get some technical reasons as to why people make the savings choices (or don't).

The programs are coming to a close - but we do have a Q&A regarding consumer protection in personal banking and finance. Very important and pertinent for young bankers who don't have experience with banking products.

This is one of those trips that we are so glad we took the time to make. Thank you to the Financial Stability Partnership for hosting this inaugural summit. We will make it a point to be here every year.

Silver State Schools Credit Union College Scholarships!

Are you a senior at a Nevada High School looking for college scholarships? Deadlines are coming up pretty fast but you can still apply for one of the six college scholarships that Silver State Schools Credit Union is offering. Be one of the six lucky students who will receive a $2,000 one-year scholarship that is renewable to up to four years. The deadline is March 16, 2013. Do not wait until the last minute to take advantage of this opportunity. To fill out an application, visit the Silver State Schools Credit Union website: http://www.silverstatecu.com/news/news-details.aspx?newsid=36

Financial Aid FAFSA- What you need to know

What are two ways that students can develop debt before they ever even graduate college? Student Loans and Credit Cards! Andson could not provide Financial Education without talking about Student Loans - that is, how to avoid them. There is a lot of information for students regarding Grants, Scholarships, and Financial Aid. The problem is, like most other information found on the Internet provided by Government offices, it's a real pain to find, and even harder to apply for.

With that, we decided that a main part of our site will be dedicated to collecting information on Grants, Scholarships, and Financial Aid.

First, you MUST get started with the FAFSA form https://fafsa.ed.gov. This is required for many schools, and for any chance of qualifying for government financial aid, and many private programs require a FAFSA filing as well. FAFSA is the US Dept of Education's Federal Student Aid program. This form should be your starting point. In other words, fill this out first! Assuming your parents are helping you with the filing process (and you're under 18) you will need the following from your parents:

Collect the documents needed to apply, including

- Income tax returns and W-2 forms (and other records of income) Tax return not completed at the time you apply? Estimate the tax information, apply, and finalize information later. The important thing is to meet the earliest deadline.

- Your Social Security number and your parents’ Social Security numbers if you are providing parent information.

- Your Alien Registration Number if you are not a U.S. citizen.

- Federal tax information or tax returns, including W-2 information, for yourself, for your spouse if you are married, and for your parents if you are providing parent information, using income records for the year prior to the academic year for which you are applying.

- Information on savings, investments, and business assets for yourself (and parents if you're providing parent information).

Here is the complete Dept. of Education's Checklist for students http://studentaid.ed.gov/students/attachments/siteresources/Coll_Prep_Checklist_3MB.pdf.

Filling this out won't take long, but it doesn't mean you're done either...Andson will be gathering more information on Grants, Scholarships, and Financial Aid for students in the next few days. The deadlines are coming up quickly, so expect to see a lot of information from us and a new category for Financial Aid on our site.

ATTENTION! View Deadlines FAFSA filings at http://www.fafsa.ed.gov/fotw1112/pdf/Deadlines.pdf

Completing the NeFe program could score you $5000 toward college!

Attention Students!

If you ever doubted what the Andson's financial education could get you, doubt no more! We use the materials supplied by NeFe (The National Endowment for Financial Education), and they just announced that just by completing the HSFPP (High School Financial Planning Program) students may be eligible for up to $5000 in college scholarships.

This is an amazing opportunity for many teens, and we hope that some of the students completing the program with Andson over Spring Break will apply.

Contact Andson for more details - info@andson.org

via NeFe's Facebook

Financial Aid Anyone?

I really like the publication put out by Charles Schwab called, On Investing. The Fall 2010 edition had a great resource for parents and students alike – regarding Financial Aid. Although there is quite a bit of detail in the article regarding specific strategies available to parents, the highlight of the article is Mark Kantrowitz and his project. Kantrowitz founded a Financial Aid information website called FinAid.org. This site is an awesome resource for anyone – teacher, parent, or student – looking for information and direction with the various processes when applying for Financial Aid. I’ve checked it out, and it seems like the site is straightforward and organized, something helpful to everyone, I’m sure. Hopefully Andson will be able to provide more information and resources regarding relevant Financial Aid information in the future thanks to individuals and ideas like this. I’m still looking for a link to Schwab’s, On Investing publication, but it doesn’t look like it appears online- I’m checking on this. Check it out at www.FinAid.org. Source: Charles Schwab On Investing publication (Fall 2010)

PASS by American Express – A new way to give teens their allowance…

It is a wonderful feeling to be able to give your kids an allowance or spending money. It’s a little less wonderful trying to figure out how they spend your hard earned cash. PASS by American Express is trying to help both parents and teens by providing a reloadable credit card/atm card that you can give to your teens.

This card is a wonderful idea! One, it allows both parents and teens to track spending habits, and gets them into an adult mentality of handling their money: balancing their account, being more aware of their spending, amongst others. For parents, it provides all the safety that an American Express credit card gives, such as fraud prevention and 24 hour a day customer service; better than that- kids cannot overspend. No more worries about sending a teen away to college with the family credit card- now you can give them a limit that cannot be exceeded. Parents can fund the card by linking their bank account, and only they can authorize more funds to be added.

The card is also hip. It may seem silly, but kids like a tailored experience when they go online – it keeps them engaged. American Express has done an awesome job of trying to keep the site and the card very much about teens. Teens will have their own login, and can monitor spending and balances- much like the typical online banking experience. The card comes in a variety of colors and you can even add your own images to the card for free.

Now for some of the Cons. The card, like most other credit card products, does come with fees. It costs $3.95 per month to use the card (though those fees are waived for a year if you sign up now) as well as $1.50 per atm transaction (the bank may also charge a fee for using their atm). Now although the costs are minimal in comparison to ever having an over-the-limit fee on a credit card, they still are monthly fees amounting to nearly $50 per year- similar to the annual cost of a credit card. It seems like the card is also better suited for an emergency atm card, or the occasional withdrawal, versus using it as many use bank-issued atm cards – those fees can add up!

There are also a few states that the card cannot be issued in:

The PASS Card is not available for sale in Arkansas, New Hampshire and Vermont. The PASS Card is also not available in California at this time. Cards purchased by residents in other states cannot be shipped to these four states. In addition, American Express does not sell or ship the Card outside the United States.

More information is supplied in the PASS FAQ section of the site

Overall, I feel that if parents can afford the fees, the PASS by American Express could be a great learning tool to get kids to care about their finances in a more responsible manner rather than simply giving them cash each week.

Source: PASS by American Express PASS by American Express FAQ